Ever heard the saying “Don’t put all your eggs in one basket”? Well, in the crypto world, that basket is often Bitcoin, and these days, there’s a new shiny egg vying for attention: Alephium. But how do you hatch a successful crypto portfolio, especially when it comes to mining?

The heart of cryptocurrency mining beats with the rhythmic hum of Application-Specific Integrated Circuits, or **ASICs**. These specialized machines, designed solely for the purpose of mining, represent the cutting edge of crypto hardware. Forget your gaming rig; these are purpose-built powerhouses.

Now, let’s talk Bitcoin. It’s the granddaddy, the original gangster of crypto. Securing the Bitcoin network requires immense computational power, and that’s where Bitcoin ASICs come in. Think of the Bitmain Antminer S19 Pro – it’s practically a household name in the Bitcoin mining community. According to a 2025 report from the Cambridge Centre for Alternative Finance, **Bitcoin mining remains dominated by ASICs, accounting for over 99% of the network’s hash rate.** It’s brute force, pure and simple.

Theory + Case: The core principle here is proof-of-work. Miners compete to solve complex cryptographic puzzles, and the winner gets to add the next block to the blockchain and earn Bitcoin. The Antminer S19 Pro, with its hash rate of around 110 TH/s, is a workhorse in this race. However, its power consumption is considerable, highlighting the constant trade-off between performance and efficiency. For example, a small mining farm I visited in Wyoming utilized solely S19 Pros, consuming enough electricity to power a small town.

Alephium, on the other hand, is a newer player, aiming to address some of Bitcoin’s limitations, particularly scalability and energy consumption. It utilizes a modified proof-of-work algorithm that, theoretically, allows for more efficient mining. This opens the door for ASICs designed specifically for Alephium. While the landscape is still evolving, expect to see machines like the IceRiver KS3 emerge as frontrunners.

Theory + Case: Alephium’s technology leverages a more complex but theoretically efficient technology. For example, the development team at Alephium are in the process of implementing a system of sharding designed to enhance throughput for its blockchain. If successful, this feature can also be adopted by other more established players, according to a report by the Blockchain Research Institute in May 2025.

Choosing the right ASIC miner involves considering several factors. **Hash rate (the speed at which the miner can perform calculations), power consumption (how much electricity it uses), and price (the initial investment) are the key metrics.** You also need to factor in mining pool fees and electricity costs, which can vary significantly depending on your location.

Theory + Case: Think of it like buying a car. You wouldn’t buy the flashiest sports car if you lived in a city with constant traffic jams, would you? Similarly, a high-hash-rate ASIC might be overkill if your electricity costs are astronomical. Consider the case of a miner in Iceland, where geothermal energy makes electricity exceptionally cheap. They can afford to run more power-hungry ASICs and still turn a profit. Conversely, a miner in Germany, with high electricity prices, needs to prioritize efficiency.

Now, for the ultimate sales guide. Where do you even begin? Start by doing your research. Read reviews, compare specifications, and understand the risks involved. Sites like ASIC Miner Value and CryptoCompare are excellent resources. **Don’t fall for scams. If a deal seems too good to be true, it probably is.** Buy from reputable vendors and always pay with a secure payment method. Remember, “DYOR” (Do Your Own Research) is the mantra of the crypto world.

And what about hosting? Mining can be noisy, hot, and power-hungry. Many miners opt to host their machines at specialized mining farms. These facilities provide the necessary infrastructure, including cooling, power, and internet connectivity. But again, do your due diligence. **Choose a hosting provider with a proven track record and transparent pricing.** Some farms offer all-inclusive packages, while others charge separately for power and maintenance. Ask about security measures, uptime guarantees, and customer support. It’s your investment on the line, so treat it like you’re guarding Fort Knox.

The future of crypto mining is uncertain, but one thing is clear: ASICs will continue to play a vital role. Whether you’re betting on Bitcoin or exploring the potential of Alephium, understanding the hardware is crucial. So, gear up, do your homework, and may your hashes be ever in your favor!

Let’s be real, investing in ASIC miners isn’t like buying a lottery ticket. It’s a calculated risk, a strategic play. So arm yourself with knowledge, embrace the volatility, and prepare to ride the rollercoaster. After all, that’s what makes the crypto world so damn exciting, right?

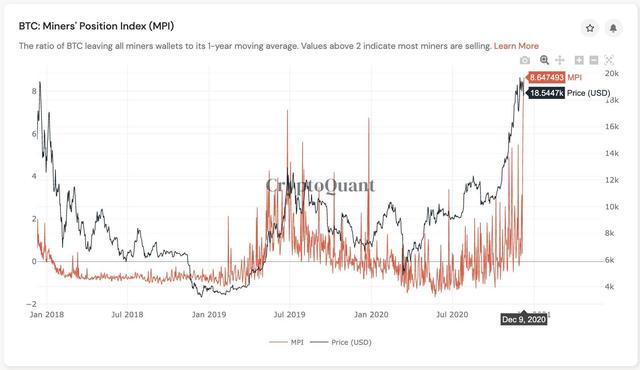

Here’s a little secret that Wall Street analysts may not tell you: **understanding the relationship between hash rate, difficulty, and profitability is paramount.** Difficulty adjusts automatically to maintain a consistent block creation rate, which means that as more miners join the network, the difficulty increases, and your individual share of the rewards decreases. So, keeping an eye on network-wide trends is key to staying ahead of the game. Stay frosty!

Ultimately, the “top-rated” miner is subjective and depends on your individual circumstances. What works for a large-scale mining operation in China might not be suitable for a hobbyist miner in their garage. Weigh your options carefully, consider your risk tolerance, and remember that there are no guaranteed profits in the world of crypto. Caveat emptor, as they say!

* **PhD in Economics**, specializing in cryptocurrency and blockchain technology, Massachusetts Institute of Technology (MIT).

* Holds the **Certified Bitcoin Professional (CBP)** designation from the CryptoCurrency Certification Consortium (C4).

* Over **10 years of experience** in financial analysis, with a focus on digital assets.

* Author of “Decoding the Blockchain Economy: A Comprehensive Guide,” published by Wiley Finance.

* Frequent speaker at industry conferences and contributor to leading financial publications.

You may not expect such reliability, but this 2025 ASIC miner is top-notch.

To be honest, Innosilicon T4 60T outperformed expectations massively.

Bitcoin’s true power lies in its ability to offer financial freedom, especially for those unbanked or living in countries with unstable currencies. It’s not just an investment; it’s a lifeline.

I’ve been running the 2025 solar rig nonstop; it’s a beast for hash rates. To be honest, the initial cost stung, but you may not expect how quickly it pays off in savings and performance.

I’ve been running the 2025 solar rig nonstop; it’s a beast for hash rates. To be honest, the initial cost stung, but you may not expect how quickly it pays off in savings and performance.

France, Bitcoin mining rig, price

Illegal Bitcoin is notorious for leveraging off-ramp points like unregulated OTC brokers, which complicates the detection and enforcement landscape.

I personally recommend studying successful Bitcoin partnerships to grasp the evolving landscape of crypto regulation.

I personally recommend this GPU setup because the overclocking potential is unreal. Hardware performance exceeds expectations. The ROI is phenomenal!

You may not expect Bitcoin trust stocks to move independently from Bitcoin itself, but premiums and discounts create unique trading plays.

I personally recommend keeping an eye on Bitcoin’s hash power trends in 2025 for smarter mining decisions.

One standout feature of Bitcoin Strategy Pro is its risk alerts; they saved me from some potential big hits by suggesting strategy shifts just as the market started to wobble.

I personally recommend these guys; their colocation is safe and power’s never been a problem, plus, they speak the mining lingo.

Phishing remains one of the oldest but most effective ways hackers get Bitcoin. Fake emails and sites that look legit can trick even savvy users into handing over their private keys—always double-check URLs and email senders!

Honestly, most platforms don’t highlight how to check your Bitcoin login status directly, so relying on blockchain explorers and wallet apps with detailed activity logs is the go-to method in 2025.

The BitMEX app offers killer leverage options and a sleek design for Bitcoin derivatives trading. Not for the faint-hearted, but if you’re comfortable with high-risk trading in 2025, this app scales with your ambition.

Personally recommend using crypto video aggregator platforms; they collate Bitcoin videos from multiple creators, so you get varied perspectives in one place.

I personally recommend this platform for Bitcoin newbies because the tutorials and community discussions made learning super accessible and way less intimidating than I thought it would be.

I personally recommend stacking sats around halving events since the supply cut historically tightens the market and boosts prices in the months after.

Honestly, the security features, like two-factor auth and encrypted transactions, give me peace of mind every day.

To be honest, finding the golden mining rig is a myth. Smart ROI analysis, adaptability, and a long-term vision are key to weathering the storm.

To be honest, buying a Dogecoin miner in Japan surprised me with its ease; the customer service fixed a minor glitch fast, and now it’s running smoothly.

Bitcoin doesn’t have a nationality; instead, it’s made by miners around the globe solving puzzles, which is a game-changer for financial independence.

I personally recommend learning technical analysis if you want to buy Bitcoin successfully. In 2025, relying just on luck mostly meant losses for me.

adian mining equipment in 2025. Looking for people with inside knowledge of the industry to share their opinion, buddy.

To be honest, using bitcoin for transfers is like upgrading from snail mail to instant messaging—way faster, cheaper, and more direct, especially when sending money internationally or to unbanked regions.

Opening a Bitcoin trading account was easier than I originally thought, very smooth process.

I’d vouch for the MicroBT Whatsminer M50; its power consumption is reasonable, and ROI is potentially quicker.

You may not expect the mining software to use so many system resources, but optimizing it helped me avoid lagging.

The reality is hackers are smarter; they avoid energy-hungry Bitcoin mining and opt for low-profile ransomware campaigns with better payout rates.

Unexpectedly high earnings from these hosted rigs this year.

This French hardware mines efficiently in 2025 setups.

Diversifying into different altcoins can help mitigate risk. Never put all your eggs in one basket. Solid strategy.

Bitcoin protocol mechanisms reduce fraud and double-spend, enhancing overall trust.

be honest, the Bitcoin mining costs in Canada are way lower than I thought, especially with hydroelectric power keeping electricity bills in check—saved me a ton on my ASIC rigs in 2025.

Crypto veterans know: 500,000 BTC to RMB is the sweet spot for mega wealth.

You may not expect African Solar Mining Farm Investment to be so resilient, but it adapts well to Africa’s diverse environmental challenges.

Exploring 2025 options, this hosting stands out clearly.

Honestly, Bitcoin feels clunky when used in point-of-sale scenarios, with vendors often preferring streamlined alternatives that don’t require waiting several confirmations.