In the ever-evolving landscape of cryptocurrency, ASIC mining devices stand as titans, driving the mechanisms that validate transactions and secure networks like Bitcoin (BTC), Ethereum (ETH), and other altcoins. As these digital currencies gain traction, understanding the dynamics of ASIC mining machines becomes crucial for informed buyers looking to invest wisely.

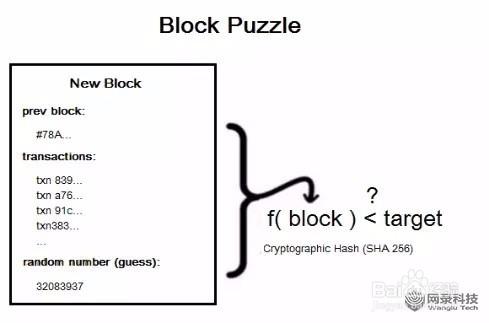

So, what exactly are ASIC miners? Application-Specific Integrated Circuits (ASICs) are bespoke hardware designed solely for the purpose of mining cryptocurrencies. Unlike GPUs, which serve multiple functions and can be repurposed, ASICs offer superior efficiency when it comes to mining specific cryptocurrencies, primarily Bitcoin. This specialisation translates into heightened performance but can also render ASICs obsolete when newer models emerge. Hence, price analysis is not just prudent; it’s imperative.

Delving into the market trends, the price of ASIC miners fluctuates based on several factors, such as the prevailing value of BTC, network difficulty, and the cost of electricity. As miners scramble to enhance their operations, understanding how these variables interlink can give buyers an upper hand. For instance, the profitability of mining can plummet if Bitcoin’s value experiences a dramatic downturn. Consequently, the miner’s operational costs, including hosting fees, become critical considerations.

Additionally, the landscape of mining machine hosting deserves attention. Companies that offer hosting services provide an attractive alternative for those unwilling or unable to manage the physical installation of mining rigs. This option alleviates concerns such as maintenance, cooling, and electricity management. However, buyers should weigh the hosting fees against potential mining rewards to ensure they are making a sound financial decision.

Meanwhile, the rise of altcoins such as Dogecoin (DOGE) and Ethereum has created a compelling scenario for miners. While Bitcoin remains the original and most valued currency in the cryptocurrency space, DOGE has captured the imagination of many due to its playful nature and viral popularity. Miners looking to diversify may find it advantageous to invest in rigs capable of mining multiple cryptocurrencies, thus hedging their investments in a volatile market.

The aspect of miner selection should not be taken lightly. Every piece of hardware available on the market presents unique specifications, performance metrics, and compatibility issues. The choice between efficiency and cost, for instance, can dictate the overall success of mining ventures. For ETH, which is transitioning to a proof-of-stake consensus mechanism, miners are now considering how traditional ASICs may fit into their long-term strategies.

Budget also plays a significant role in the decision-making process. Quality ASIC miners come with a price tag, but the more efficient models often promise a better return on investment (ROI). For newcomers intrigued by cryptocurrency mining, understanding the timeline for ROI is crucial. While some might aspire to earn back their investments in months, others may need to recalibrate their expectations based on market volatility and hardware capabilities.

Mainstream exchanges play a pivotal role in this ecosystem, providing platforms for buying and selling cryptocurrencies. These exchanges are flooded with ASIC miners, so buyers can evaluate performance data and previous buyer reviews, making more informed decisions about their purchases. With a simple click, one can compare features and prices across various platforms and also find pertinent information about the longevity and efficiency of different models. This shows that thorough research can lead to smarter investments.

In the quest for the ultimate ASIC miner, buyers must also stay abreast of the latest technological advancements. Established miners frequently release upgraded models boasting improved hash rates, energy efficiency, and thermal management solutions. As a result, an effective price analysis involves not merely monitoring current prices but also forecasting future trends based on technological developments.

In conclusion, while the world of ASIC mining presents lucrative opportunities, it is peppered with complexities that can confuse even seasoned investors. By understanding the nuances of price dynamics and remaining vigilant in their research, buyers can make choices that not only fulfill their immediate interests but also align with long-term goals in the fluctuating realm of cryptocurrencies.

A deep dive into ASIC mining hardware costs. More than just price tags, it’s about ROI, power consumption, and future profitability. A crucial guide for serious miners!